Asset protection involves a plan that will best position and protect the medical spa business, its owner, employees and clients from unforeseeable occurrences. Natural disasters, accidents, work injuries and crime unfortunately do occur, and these occurrences are not only costly, but they come with significant legal ramifications. Any medical spa owner is wise to plan for the safety and protection of their business.

There are several matters to think about when contemplating asset protection, but this article focuses on three of the most common and impacting areas, each to be carefully considered:

- Selection of a legal formation

- Identifying insurance needs and appropriate coverage

- Theft prevention and planning adequate security measures

Legal formation

The formation of the legal entity of a medical spa is the starting point in developing a strategy to safeguard both owner and

For example, if you run a business as a sole proprietorship, you will be personally liable for any debts or judgments associated with your business. The amount that you can be required to pay may extend beyond the income you make from the medical spa, which, in turn, may impact personal finances and assets such as your home, car and other personal items.

On the other hand, if a corporation or limited liability entity is selected as the legal framework for your business, typically your liability for business debts would be limited to the amount of your investment in the medical spa. The result here being that you might lose your business, but you wouldn’t lose personal assets.

It is highly recommended that any medical spa owner consult with an attorney and accountant before selecting a business format, as they can aid in the decision about which format is best suited for a particular business.

Insurance

A new owner, focused on monthly expenses such as rent, payroll and marketing, may feel that insurance can take a backburner to the costs of day-to-day operations. This kind of thinking is a mistake, as well-thought out insurance coverage not only eases your mind, but also can save your neck. In the event of a large, uninsured loss, the medical spa’s ability to stay afloat would likely be threatened. Why risk it all? A good way to get started in heading off this problem is to contact an insurance professional early on.

“Make sure you have professional liability insurance, a policy that covers your medical director, any treating physicians you have on your staff, and others who provide patient care,” suggests Bob Tucker, president of Valcourt Insurance, an insurance agency specializing in coverage for medical spas. According to Tucker, the most frequently asked question regarding professional liability is: “My physician has medical malpractice insurance, so that is all we need, right?” Wrong.

Most physicians’ specialties will not extend medical malpractice coverage to cover their professional activities at a medical spa. Usually only plastic surgeons’ and dermatologists’ coverage will follow them to that type of facility. The trend for major medical malpractice companies is to limit coverage to the individual physician’s specialty. Therefore, an obstetrician-gynecologist’s medical malpractice coverage would not provide coverage for esthetic procedures done in a medical spa.

In addition, most physicians’ medical malpractice coverage will not cover the physician while acting in the capacity of a medical director. A medical director is the physician that comes in to set policy and procedures, as well as check charts to make sure the medical personnel performing the esthetic treatments are following medical protocols to the prescribed manner. Again, the major medical malpractice companies do not want this exposure and will not extend coverage under the physician’s medical malpractice policy.

And still there are many individuals who think that nothing will ever happen to them or their medical spa. Claims happen. Consider the example of a $25,000 claim after a clinician burned a patient during a laser hair removal treatment.

So what is the answer? Write a policy that will cover the corporation or entity, the medical director for activities such as checking charts and setting policy, registered nurses and estheticians for treating patients, and even coverage for a physician if they want to treat patients. All professionals and the corporation itself covered under one policy, sharing the limits of said policy, is likely the best solution.

Tucker advises that property insurance, which covers all of your property and business property, such as the laser machines and equipment needed to run your medical spa, and general liability insurance, which provides coverage for bodily injury, typically for slip and fall cases and property damage you are responsible for, usually takes form through a business owner’s policy.

Tucker also encourages medical spa owners to have business interruption insurance coverage, which provides monetary relief if you couldn’t run your business or had a major loss and had to shut down. This would cover, for example, the downtime during repairs from a fire.

Make sure that you also have worker’s compensation insurance. This is the coverage that pays the medical care and disability payments for an employee who is injured on the job. This coverage is mandatory by state law.

Another type of coverage that can be added to a business owner’s policy, at an additional cost, is product liability insurance. If your medical spa sells cosmeceuticals and other skin care products, you may be sued if someone is injured using the product. Of course, anyone can sue you for any reason, and this holds true even if your medical spa simply carries the product and has nothing to do with its design or manufacture.

Weighing the cost of insuring against the economic impact of an uninsured loss is one way to sort out priorities. For example, to avoid further expense, you may decide to forgo terrorist insurance. Insurance premiums can make a substantial dent in any business’s budget, but carrying too little insurance leaves you vulnerable and may even violate state or federal laws.

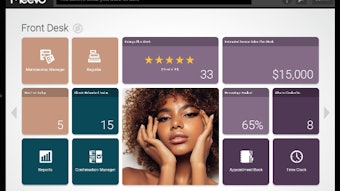

Employee theft

Employee theft, even in a medical spa, is unfortunately more likely a question of when, not if. Think it can’t happen in your medical spa? Consider the unfortunate but true occurrence of a clinical staffer walking away with $10,000–20,000 worth of Botox*, or another giving away services for free by erasing the scheduled appointment on the business’s computer system.

The first step to combat internal theft is to remove the temptation. The best way to do that? Think about easy targets and where there is an opportunity for dishonest behavior, and then put a discouraging mechanism in place. For example, consider inventory control on items such as skin care products, injectables and other retail products, as well as controls on discounts, gift cards and ticket sales.

Industry experts usually recommend engaging a public accountant to audit your cash flow and accounts annually, and to take product inventory on a monthly basis. You may opt to conduct these audits more frequently, as there is no foolproof system that will prevent employee theft. However, having a consistent and frequently monitored internal control system in place may discourage this type of activity. As part of your security program, include policies in your medical spa’s employee handbook. You may choose to address topics such as:

- Areas of limited access

- Restrictions on visitors

- Statements regarding the removal of company property

- Security systems and procedures

- The handling of customer and company data

- The supervision and verification of medical spa purchases and deliveries

An owner can’t afford to overlook the security of the medical spa, its staff, clients and property. Security addresses the ways you can protect your business from burglary, theft and other types of crime. There are many simple precautionary measures—alarm systems, adequate lighting and lock-and-key controls—that are simple, yet effective, security measures.

If you think there is a low likelihood that a burglar might make off with your property, think again. Here’s another true and unfortunate situation involving a medical spa whose computer system was stolen—not once, not twice, but three times! The third time, the computer was stolen by knocking down a wall and thus avoiding the newly installed burglar system. You can imagine the resulting impact.

PRM Global, LLC, a company specializing in protection risk management, devised a series of hypothetical questions you should ask as medical spa owner.

- What would be the impact on your medical spa if your client data or personal information was lost or stolen?

- What would be the impact on your medical spa if your equipment were stolen?

- What would be the cost in downtime while obtaining and waiting for replacement equipment, even if insured?

- What would be the effects of your clients feeling “more vulnerable” because your medical spa was victimized by crime?

- What is your liability if reasonable means were not taken to protect your customers?

All business expenditures, including security, must be justified on a cost/benefit basis. PRM Global offers the following suggestions.

Professional and free security advice. Many local law enforcement agencies have officers who will come to your medical spa and conduct a security vulnerability study to advise the best proactive measures for your specific business and location. Private security companies are also available for this type of service. You may have to determine what is actually “needed”, as opposed to “nice to have,” and it is therefore recommended that you obtain advice and bids from at least three reputable local security companies before making your decision.

Effective lighting. Indoor and outdoor lighting is one of the least expensive, but most effective, criminal deterrents. Darkness communicates no activity and assists in the concealment of burglars and their actions. Make sure all entrances and parking areas are adequately illuminated, as well as other high-risk and criminal prone areas.

Monitoring systems. Video surveillance systems are strong deterrents, as are intrusion detection systems, such as burglar alarms. The cost of video surveillance continues to decline as its effectiveness increases. If your medical spa is victimized by crime, an effective video surveillance system will aid in the apprehension of the perpetrators and recovery of your stolen assets. PRM Global recommends a video surveillance system installed by a reputable local vendor who will ensure at minimum that you have dependable surveillance record capability. Make sure to post surveillance, alarm and armed patrol signs or stickers on access points, such as doors, windows, delivery or cargo areas and parking areas.

Lock-and-key. Lock-and-key mechanisms are a basic safeguard to prevent unauthorized access. Electronic key card access control systems offer considerably more protection than your standard key lock sets, and, additionally, an access key card can be disabled or have its accessibility removed using accompanying software with just a few computer strokes. The initial cost of an electronic key card access control system is much higher than a standard key set, but a good number of high-end commercial properties use key card access control devices, and that number continues to grow. If you are planning to locate your medical spa in an office or medical complex, you may consider negotiating the installation of a key card access control system in your lease.

Standard key lock sets are easily compromised, but still provide protection. Below are a few tips on key control:

- Account for all keys with documented initial and periodic inventories.

- Compartmentalize access through limited, standard and master keys and locks.

- Issue as few keys as possible.

- Before a key is issued, be sure the person has demonstrated trustworthiness.

- Have all keys stamped with “Do not duplicate.”

- Follow this rule: One person, one key. And no “loaning out” of keys.

- Lock up all extra keys and control who can duplicate keys.

- For the maximum protection, change locks and keys when a key is lost, when warranted by any employee's behavior, or when any employee is terminated or voluntarily quits.

Protect your spa

A medical spa is an expensive business investment with start-up costs typically running well over $600,000, with sizable resources allocated in real estate, design and construction, laser equipment, human resources marketing and more. Owners and operators devote most of their time and energy to the business’ development, often overlooking this very important piece of business strategy. Asset protection can take on many forms, and this article was intended to provide a framework for crafting your own plan for asset protection. As with many things in life, your safest bet is to expect the best and plan for the worst.

* Botox is a registered trade name of Allergan, Inc., Irvine, CA.