Early in her career as a skin therapist, a wonderful esthetician—let’s call her Madge—was visited by a client for her routine age management treatment. Upon her arrival, the client told Madge she had just been to her dermatologist and had a biopsy on a lesion she and Madge had been following for a year.

Truthfully, Madge had mentioned it to her on several occasions, and told her she should have it checked. The client had multiple problems with her skin—acne, pigment changes, photodamage—and Madge was diligently supporting her with appropriate education, treatment and products. The client’s home care compliance had increased; she was routinely wearing her sunscreen, and except for an occasional tan, she was doing well.

Now, most of you are likely experiencing the following thoughts:

“I would NEVER work on someone with a tan.”

“I would NOT work on someone with a suspicious lesion.”

“I would have known this was a problem.”

“I would NEVER have touched this woman.”

Rest assured, with many more years of experience, Madge too would handle this situation differently. The lesion did turn out to be a basal cell carcinoma, but luckily for both of them, it was caught early, as basal cell carcinomas are typically slow-growing, and the client had minimal tissue removed. Today there is no sign of the aforementioned lesion, and Madge continues to treat this client’s skin—a good outcome.

Risk management defined

This scenario had the potential of being a nightmarish event in today’s litigious environment. However, the risk to Madge and her business could have been significantly minimized by applying a few risk management techniques.

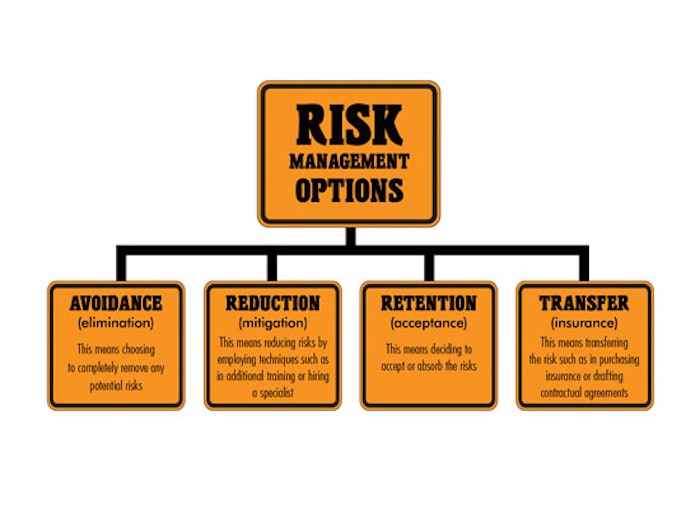

Accepted convention views risk management in four basic categories: avoidance, meaning eliminating all potential risks; reduction, meaning reducing risks by employing measures that minimize potential risks; retention, meaning totally accepting risks; and transfer, meaning shifting the risks to another body, such as in purchasing insurance or making contractual agreements, which ultimately has other parties sharing in the risk.

Risk management is defined on www.entrepreneuer.com as, “Decisions to accept exposure or reduce vulnerabilities by either mitigating the risks or applying cost-effective controls.” Today, as a risk management measure, Madge has purchased professional and general liability insurance in addition to reworking her informed consent document to include a sentence that absolves her of liability should she be confronted with a similar circumstance in the future.

However, fleshing out some risk management ideas from different vantage points can help ensure other spa professionals that they won’t end up, perhaps unknowingly, in jeopardy of litigation.

Minimize risks as a skin care professional

Skin care specialists are truly remarkable individuals. They are intrinsically motivated to help people; often visually oriented; tactile; sensitive; and generally care about the health and well-being of others. As another broad generalization, many also are still learning about the care and protection of themselves—namely their exposure risks.

Not so long ago, when just a few professionals were practicing, the rules were clear. You were trained, you got a job and your employer took care of the business details, including insurance. With growth and development, some skin care specialists became business owners, which involved purchasing equipment and products and maybe employing one or two people. As part of the package, the bank or an insurance salesperson recommended purchasing general liability insurance. As a general practice, skin care professionals diligently complied, not really knowing all of the ramifications of being underinsured and overexposed to unknown risks. The term risk management was hardly on the radar at all.

Today, a myriad of issues have changed and morphed the environment for skin care professionals. With the globalization in trade of goods and services, you are now all business people. Like it or not, you are in charge of your work and lifestyle pursuits, and for managing your risks to peril, so you would be remiss not to take advantage of a few pointers on how to best protect yourself and your business.

Obtain professional and general liability insurance. This is particulary important if you are working as an independent contractor. Insurance professionals say it may not be enough to have professional liability insurance if you work as an independent contractor, particularly in the event one is named individually in a claim. Case in point, according to Samantha Strickler of Strickler Insurance, “… if you are working for a salon as an independent contractor and you leave the wax machine on and a fire ensues, the salon owner’s general liability insurance will cover the business’ recovery expenses; however, the owner could ask you for expenses, which would be out-of-pocket if you do not have appropriate coverage.” Strickler continues, “The take-home here is, in addition to having professional liability insurance as an independent contractor, it is wise to have general liability insurance as well.”

Use appropriate documentation and conventional charting methods. It’s important to document any deviations from the normal protocol of a treatment or service. Moreover, “papering your file” with as much documentation as possible is another recommendation Strickler further says, “If a claim does occur against you, you can paint a picture for your defense with your documentation. Without it, you may be proven negligent.”

Take a good look at your employer’s insurance policy with yourself in mind. Katie Armitage, president of Associated Skin Care Professionals, says, “Many skin care professionals who work in spas, salons and physicians’ offices mistakenly believe their employer’s coverage protects them. If a claim is made, your employer’s policy may not cover you if you are named in the claim. It is unlikely to cover your court costs, legal expenses and settlement fees. Review your employer’s policy carefully and read the fine print, otherwise you are at risk.

“Employers often assume their staff members are protected because they don’t fully understand their own insurance policy,” Armitage adds. “One of our own staff members owns a small day spa and made this mistake. When she came to work for us and learned more about insurance, she dug deeper and discovered her staff was not covered. An employer might also forget a payment or fail to renew a policy, leaving staff at risk. Most often, an employer’s policy will not cover you if you work in locations outside the business premises or offer services out of your home. Also, some treatment or techniques you provide may not be covered by your employers’ policy. If your employer’s insurance doesn’t cover you, guess who’s responsible for those costs? You are.”

Add a client waiver statement to your informed consent document. This will help absolve you of any liability if a client refuses to seek medical attention as recommended. Often clients become like family members or friends, and some professionals become more lax in these instances. However, if your client has a medical condition, you absolutely need to refer her to a medical professional and should reschedule the treatment until she has been seen by a dermatologist or qualified health care authority.

Do not publicize or discuss with a client that you have professional or general liability insurance. This gives unprincipled, scheming types carte blanche to take advantage of your insurance capital. Experts say it doesn’t matter how well you know an individual, it is best not to share your insurance coverage or any information that may potentially be a risk management issue.

Safeguard yourself when performing treatments internationally. While doing business outside of the United States, make certain you have systems in place to safeguard your products, equipment and transactions. It is necessary to have a monitoring body responsible for keeping your products and services safe, environmentally sound, reliable, efficient and cost-effective. The International Organization for Standardization (ISO) is a nongovernmental organization network of more than 100 countries with central offices in Switzerland. ISO serves to ensure the quality of products and services worldwide. For member services, support and more informantion, log on to www.iso.org.

Make certain your equipment is in good repair. Inspect all equipment as a routine practice. If a device is not working properly, get it in for repair as soon as possible. Also, look for unexpected risk management issues that can become a problem, such as a treatment bed or chair on wheels. Make certain these items have brake features.

Obtain and use protocol home care compliance documents. This ensures you have done your part to make certain your clients are using their home care products correctly. This becomes especially important if the client is preparing for a surgical procedure. And always make a signed copy and put it in the client’s file.

Attend continuing educational events and workshops. As a practitioner, it is your responsibility to make certain you remain qualified to use the equipment, peels and other devices you apply to and use on a client. For example, do not assume a peel you have used for years has not been through some changes. Ask for updates on material safety data sheets), as well.

Risk management considerations

Along with the countless details an owner of a spa, clinic, salon or other skin care facility has to manage, it is necessary to maintain a proactive, transparent risk management program that may involve multiple layers. Undoubtedly, having a few risk management techniques handy is great for every forward-thinking, entrepreneurial business owner.

Have compassion for your business by remaining detached. This sounds like something out of a New Age seminar, but in reality, everyone has made emotional decisions about their business because they somehow believe it is their baby. Sometimes a business needs to grow up. Get outside help if you find you do not have objectivity about your business. Local small-business development centers often offer free support and can offer business assistance that will inevitably minimize risks with everything from financial matters to having employees sign noncompete agreements. The more impartial you can be about your business, the more precise your decisions will be in providing for its sustenance.

Trust your gut. When you have that negative, gut-level feeling about a client, employee or vendor, trust it. Many people often can look back at a circumstance or incident that has created a business problem and recall something that just did not feel right. It is important to safeguard your intuition.

Know when you need outside help. If you get into a crisis with an employee and a resolution is not in sight, bring in a qualified mediator. Sometimes you may hit a wall with someone, or the situation could become too hurtful or depressing to deal with effectively. These are both good reasons to hire a mediator. Sometimes it can be a lengthy proposition, but it might be money well-spent in the long run. Through the process, you may discover unhealthy patterns repeating within your operations that are crying for a call to action. It can be difficult to look at your own shortcomings, but it’s necessary.

Make certain the equipment that you are using is covered by liability insurance. You may find that while your waxing services, microdermabrasion and chemical peels are covered, permanent cosmetic applications or electrolysis may not be. Checking with your state laws, rules and regulations is essential to remain compliant and official as well. Due diligence goes a long way to avoid expensive course corrections.

Risk management for manufacturers

Charles Stevens, program division manager for Marine Agency Corporation, offers some key suggestions as an overview to spa product and equipment manufacturers. Many of these ideas can be carried over to anyone in a business where products and equipment are being developed.

Batch numbering. Products should be numbered by production line and date. Batch numbering should also be tied to sales information in order to facilitate an expedient a recall, if necessary.

Product labels and instructions for use. These should be periodically reviewed by legal counsel to ensure accuracy,U. S. Food and Drug Administration compliance and ease of understanding for the consumer.

Insurance from suppliers. Obtain evidence of product liability insurance from all suppliers. David Suzuki, president of Bio-Therapeutic, Inc., says, “Evidence of product liability is standard practice for reputable manufacturers. Furthermore, you should inquire about ISO and Canadian Standard Association certifications. These certifications ensure you are dealing with a company that takes safety, consistency and quality seriously.”

Independent testing. Quality control is a critical issue for all manufacturers and distributors. Where possible, periodic independent testing and certification is a great idea.

Insurance is also critical in risk management, so you should seriously consider purchasing the following types of coverage.

- General liability, including product liability coverage. Covers against lawsuits arising out of the operations of a business.

- Property coverage. For buildings, if owned, and their contents, including furnishings, fixtures, supplies and inventory.

- Business interruption and extra expense coverage. Covers loss of income following a covered loss, such as a fire.

- Workers’ compensation. Covers on-the-job injuries and disease.

Also, be on the lookout for sleepers, or hidden risk management issues. Among the most prevalent of these are:

Product recalls. These can be very expensive and are not automatically covered under a general liability or product liability policy, though separate coverage may be available.

Employment practices suits. Issues such as sexual harassment, wrongful termination and a hostile work environment usually come without warning. Defending yourself against a single suit—even if groundless—can cost $25,000 or more in legal fees. Separate coverage, called employment practices liability insurance, is available to protect employers from employees’ claims.

Crisis management and disaster recovery plan. These should be included in overall risk management plans. Businesses should plan ahead for all possible contingencies, including incidents of workplace violence, product recalls and temporary locations with emergency supplies and inventory following a property loss.

Risk management in marketing

Janet D’Angelo, president of J. Angel Communications and the author of Spa Business Strategies: A Plan for Success (Milady Publishing, 2005), has many useful tips for new and existing businesses engaging in the practice of marketing and advertising.

She says, “When it comes to marketing, creating a name and logo is the first order of business in branding a salon or spa’s identity. This is a task most spa owners take great pride in, but it is important for small-business owners to understand the legalities involved. This generally includes registering your business name at both the state and local levels. You should also check with the United States Patent and Trademark Office to be sure you are not infringing upon the trademark rights of another business. Unwittingly copying the design or name of another business can get you into trouble even if that other business has not registered a trademark. All of this can be confusing to the new business owner, so it is always best to seek expert legal advice in these matters.”

Additionally, D’Angelo recommends, “Spa owners should be aware of any restrictions or requirements when it comes to advertising name brand products and patented techniques. Most manufacturers and developers are eager to showcase their products and are often happy to support you in your efforts; however, when it comes to representing their wares, they may require the use of certain trademark symbols or language. Marketing professionals take extra care to research these facts before placing them in media outlets. If you are creating your own advertising materials or relying on media personnel to create a design, be sure to investigate these important items yourself. While media reps are often happy to assist you in creating an ad, the ultimate responsibility for content is yours.”

D’Angelo makes a great case for doing the preliminary homework it takes to front-load risk management details in a business plan. Furthermore, the importance of enlisting the help of qualified people who know how to do the research ahead of an important launch date for a business or product is essential.

Seek good council

As skin care specialists, it is important to have a diverse and comprehensive support team composed of professional members with whom relentless study is a common theme. You need people around you who are current on rules and regulations, laws, procedures and education, as well as those with whom you may have a confidential discussion.

Some topics are better shared in the offices of paid professionals rather than in a discussion with a friend, delivered in a panic over a martini. Make certain you have the best resources in front of you for conversations involving a potential liability.

Debbie Higdon of Associated Skin Care Professionals serves in risk management and offers, “I’m often the first person skin care professionals talks with if a claim is made, and I can hear the anxiety in their voices, even if they don’t believe the claims have merit. Having someone to turn to is so important to them. They are always so relieved to have the matter settled.”

There is nothing like having calm, well-trained professionals at the other end of the phone when you need them. Additionally, when reviewing your insurance policies, wording can quickly get confusing. It’s always a good idea to have a qualified insurance agent, broker or attorney assist you with the review.

Know yourself

Having an emotional safety net in place for support is invaluable with the busy lives people lead today. It is imperative you have people around you who care for and support you as an individual.

If you feel at risk personally, it is vital to enlist the help of a good therapist or mental health specialist to work through difficult issues. Risk management issues can crop up around people having a loss of confidence, and a domestic issue or personal problem can affect the way you are functioning on the job, thus lowering your ability to concentrate or perform well. Knowing yourself and when to reach for help is simply good business.

Skin care professionals know the heart of their practices revolves around the caring of their clients. Examined closely, you develop relationships with clients and with your work, which supports you and your business on many levels. It is rare you do incur problems; however, you must anticipate unforeseen events by being stewards not only to yourself but to your profession. Once risk management systems are in place and are reevaluated on a continual basis, it becomes more an issue of practice management. And that is something everyone understands.

GENERAL REFERENCES

K Armitage, Insure Your Work, Improve Skills, Reduce Your Risk, California Stylist & Salon (April 2008)

M Crouhy, D Galai and R Mark, The Essentials of Risk Management, McGraw Hill, New York (2006)

J D’Angelo, Spa Business Strategies: A Plan for Success, Milady Publishing, Clifton Park, NY (2007)

S Deitz, The Clinical Esthetician, An Insider’s Guide to Succeeding in a Medical Office, Milady Publishing, Clifton Park, NY (2004)

T Foster, Build long term relationships with your employees, Business Today, www.businesstodayinc.com/articles/article_longterm.html (2007) (Accessed May 30, 2008)

WJ Kwon and H Skipper, Risk Management and Insurance: Perspectives in a Global Economy, Blackwell Publishing Ltd., Malden, MA (2007)

K Sadgrove, The Complete Guide to Business Risk Management, 2nd ed, Gower Publishing Ltd., Burlington, VT (2005)

B Schlossberg, Be Ready for Risks, Massage magazine (February 2008)