Only on SkinInc.com: Exclusive commentary from Myra Y. Irizarry of government affairs for the Professional Beauty Association, on how this tax credit would benefit your spa financially.

As reported by the Professional Beauty Association (PBA) and the National Coalition of Estheticians, Manufacturers/Distributors and Associations (NCEA), the skin care industry needs your immediate action.

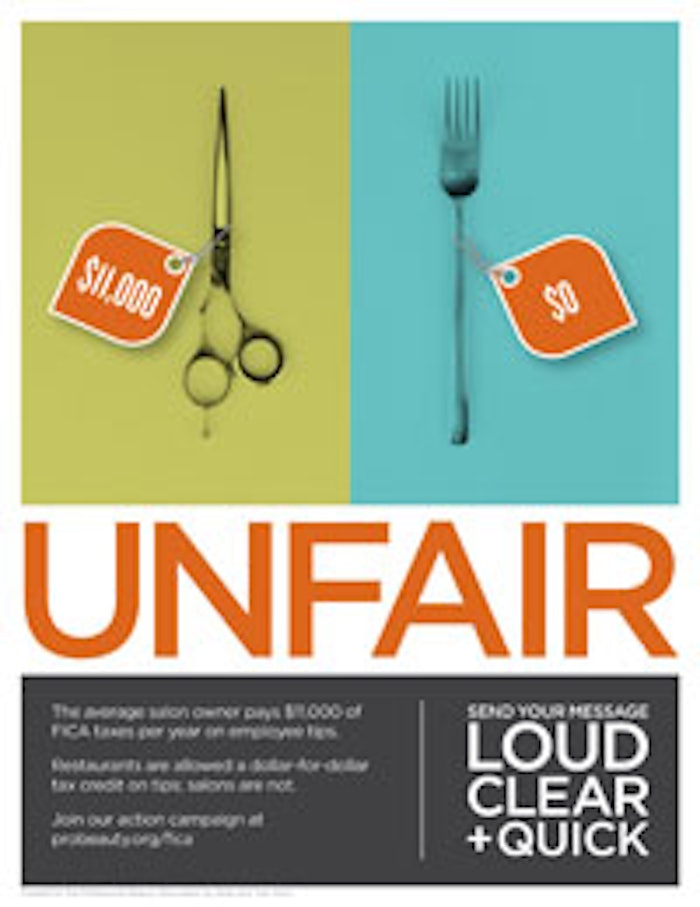

The Small Business Tax Equalization and Compliance Act has been introduced. This act will provide the beauty industry a dollar-for-dollar tax credit on FICA (social security and Medicare) taxes paid on employee tips. Click here to sign on to PBA's letter to Congress today! Show your support for the Small Business Tax Equalization and Compliance Act. Any questions? Visit probeauty.org/advocacy or contact PBA's government affairs team at 800-468-2274.

Myra Y. Irizarry of government affairs for the Professional Beauty Association, tells SkinInc.com how skin care professionals can benefit financially from this tax credit.

The Small Business Tax Equalization and Compliance Act, known commonly in the beauty industry as the FICA Tip Tax Credit, has been introduced in Congress by Senator Olympia Snowe (Senate Bill 974) and Congressman Sam Johnson (House Bill 1957). The legislation, if passed, would extend the current 45(b) FICA tax credit to salon/spa owners—a credit granted to restaurant owners in 1993—while providing equality and increased compliance for America’s small businesses in the salon/spa industry.

Like the restaurant industry, salon/spa professionals receive a significant amount of their income through tips, which, by law, must be reported as income. Salon/spa owners do NOT receive any of this tip income, yet are required to pay taxes on it. Beauty industry employers are responsible for paying the 7.65% FICA (social security and Medicare) taxes on all employee income, including customer-paid tips. While the restaurant and salon/spa industries share tip reporting burdens, spa owners continue to shoulder the added burden of paying FICA taxes on the tip income of their employees. Along with ensuring tax fairness, the FICA credit could help offset administrative costs associated with ensuring employee compliance on reporting tips and allow business owners to reinvest in their business and employees.

Job growth in the spa industry has outpaced the overall economy in eight of the past nine years; 2008 marked the industry’s 16th consecutive year of job growth. Home to a large number of entry-level jobs with significant potential for training and upward mobility, the vast majority of managers and salaried employees in salons/spas started out in entry-level positions. Additionally, the spa industry is one of America’s most diverse industries. According to the Bureau of Labor Statistics, the spa industry employs a higher proportion of African-Americans, Asians and women than the overall U.S. workforce. Even so, this industry is not immune to the current economic crisis. Extending the 45(b) tax credit to spas will help this vibrant and important sector.

The Small Business Tax Equalization and Compliance Act is the professional beauty industry’s opportunity to gain tax fairness through a dollar-for-dollar tax credit on all FICA taxes paid on employees tips. Visit probeauty.org/advocacy and click on the “Take Action Now” button to send a letter to Congress in support of the FICA Tip Tax Credit.